The Advantages of Npv Are All of the Following Except

It allows the comparison of benefits and costs in a logical manner through the use of time value of. The advantages of NPV are all of the following EXCEPT A it can be used as a rough screening device to eliminate those projects whose returns do not materialize until later years.

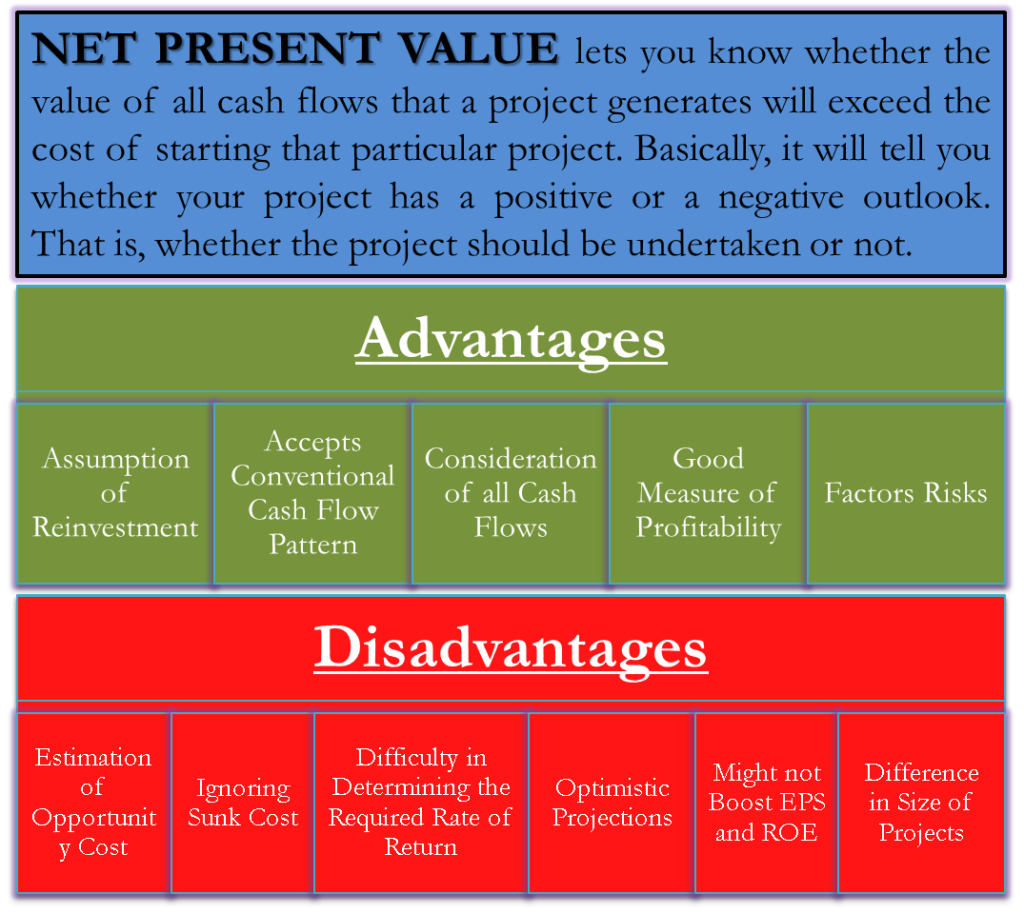

Advantages And Disadvantages Of Net Present Value Npv Efm

Furthermore it assumes immediate reinvestment of the cash generated by investment projects.

. One disadvantage of using NPV is that it can be challenging to. The major difference between the Net Present Value method and the Annual Rate of Return method in evaluating a capital project is a. A it can be used as a rough screening device to eliminate those projects whose returns do not materialize until later years b it provides the amount by which positive NPV projects will increase the value of the firm c it allows the comparison of benefits and costs in a logical manner through the use of time value of money.

Facilitate borrowing to finance all infrastructure projects. 1 Answer to The advantages of NPV are all of the following except. 6 The internal rate of return is.

The ARR method focuses on overall profitability of a project. Net Present Value has a significantly high sensitivity to the discount rate when figuring out this ratio because its the summation of multiple discounted cash flows. It provides the amount by which positive NPV projects willincrease the value of the firmc.

It then takes positive and negative information to convert the figures into a present value. It is highly sensitive to the discount rate used. NPV accounts for investment size.

It recognizes the timing of benefits resulting from the project. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. All positive NPVs will increase the value of the firm.

It can be used as a rough screening device to eliminate those projects whose returns do not materialize until later years. The advantages of NPV are all of the following EXCEPT. Advantages of the NPV method.

The advantages of NPV are all of the following EXCEPT. It provides the amount by which positive NPV projects will increase the value of the firm. 5 The advantages of NPV are all of the following EXCEPT A it can be used as a rough screening device to eliminate those projects whose returns do not materialize until later years.

The advantages of NPV are all of the following EXCEPT. If the NPV for a project is 0 it indicates that the project will _____. It provides the amount by which positive NPV projects will increase the value of the firm.

It recognizes the timing of the benefits resulting from the project. It can be used as a rough screening device to eliminatethose projects whose returns do not materialize until lateryearsb. It recognizes the timing of the benefits resulting from the project.

It allows the comparison of benefits and costs in a logicalmanner through the use of. The disadvantage is that it is more complex than other methods that do not consider present value of cash flows. The advantages of the net present value includes the fact that it considers the time value of money and helps the management of the company in the better decision making whereas the disadvantages of the net present value includes the fact that it does not considers the hidden cost and cannot be used by the company for comparing the different sizes projects.

The advantages of NPV are all of the following except. The advantages of NPV are all of the following except. B it provides the amount by which positive NPV projects will increase the value of the firm.

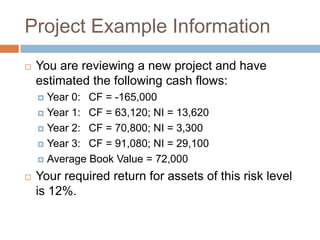

The net present value NPV rule is essentially the golden rule of corporate finance that every business school student is exposed to in most every introductory finance class. After estimating a projects NPV the analyst is advised that the fixed capital outlay will be revised upward by 100000. It allows the comparison of benefits and costs in a logical manner through the use of time value of money principles.

A list of the top executives in the proposing firm. The NPV calculation helps investors decide how much they would be willing to pay today for a stream of cash flows in the future. The fixed capital outlay is depreciated straight-line over an eight-year life.

Project proposals should include all of the following EXCEPT _____. The NPV method is easier for managers to justify than the ARR method. The obvious advantage of the net present value method is that it takes into account the basic idea that a.

It allows the comparis. 0 1 pts Question 2 Incorrect Incorrect Advantages of a capital budget process include all the following EXCEPT. It allows comparison of benefits and costs in a logical manner.

The required rate of return is 8 percent. It estimates wealth creation from the potential investment in todays dollars given the applied discount rate. The advantages of NPV are all of the following except.

The tax rate is. Improve equity across generations. The use of NPV as an investment and capital budgeting criterion features key advantages and disadvantages.

Regularize purchase of infrastructure assets. It can be used as a rough screening device to eliminate those projects whose returns do not materialize until later years. NPV provides an unambiguous measure.

Which of the following is NOT an advantage that favors the use of weighted scoring models. Extra review of infrastructure projects to prevent mistakes. The basic advantage of net present value method is that it considers the time value of money.

It provides the amount by which positive NPV projects willincrease the value of the firmc. It can be used as a rough screening device to eliminatethose projects whose returns do not materialize until lateryearsb. Using the following formula we find that the.

The NPV rule dictates that investments should be accepted when the present value of all the projected positive and negative free cash flows sum to a positive number. It allows the comparison of benefits and costs in a logical manner through the use of time value of money principles. The ARR method is easier for accountants to justify than the NPV method.

Advantages And Disadvantages Of Npv Net Present Value Examples

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Comments

Post a Comment